Stocks/Bonds

Gifts of long-term, appreciated stocks and bonds are a smarter way to give because they provide a potential double benefit: You will be eligible for both a charitable tax deduction for the value of the securities on the day you transfer, and you may not be responsible for taxes on any gains from the time you acquired them. To make a gift of stock to the church, please provide the following to your broker to initiate the transfer:

Charitable IRA Transfers (QCDs)

If you are age 70 1/2 or older, you can transfer up to $100,000 each year directly from your traditional IRA account to the church.

This smarter way to give may satisfy a portion or all of your annual required minimum distribution (RMD) and serve as a qualified charitable distribution for your IRA, which can save you on taxes even if you do not itemize! Contact your plan custodian to complete the IRA transfer.

Important notes on Charitable IRA Transfers (QCDs):

If you are age 70 1/2 or older, you can transfer up to $100,000 each year directly from your traditional IRA account to the church.

This smarter way to give may satisfy a portion or all of your annual required minimum distribution (RMD) and serve as a qualified charitable distribution for your IRA. This type of gift can save you on taxes even if you do not itemize! Contact your plan custodian to complete the IRA transfer.

Please request your IRA custodian directly mail the check to:

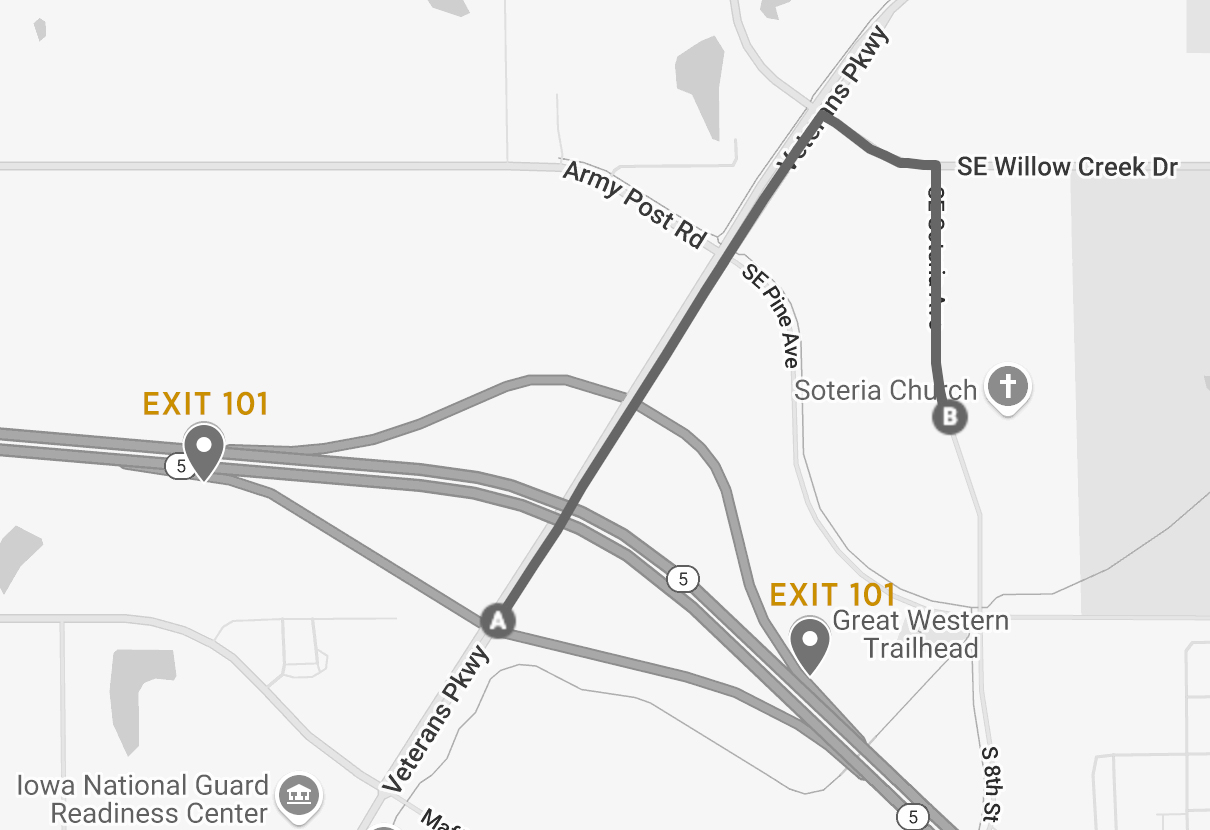

Soteria Des Moines

3250 SE Soteria Ave.

West Des Moines, IA 50265

Essential notes on Charitable IRA Transfers (QCDs):

- This particular way to give only applies to traditional or Roth IRAs. Retirement plans, such as the 401k, 403b, and others, do NOT qualify.

- While The SECURE Act did change the required minimum distribution (RMD) age to 72 for those under 70 ½ as of December 31, 2019, it DOES NOT change the age eligibility for making a qualified charitable distribution (QCD) through an IRA. For those who are between 70 ½ and not yet 72, the QCD amount would not offset this year’s RMD because none are owed yet.

- In 2021, IRA owners age 72 and older resumed their required minimum distribution (RMD) from IRAs. By exercising an IRA qualified charitable distribution (QCD), you may satisfy all or a portion of your RMD for the year and reduce reportable taxable income.

- If your IRA custodian provides you with an IRA checkbook, please write the check to Soteria Des Moines. Due to different IRS requirements for this type of transfer, please consider mailing your check no later than December 1 to provide adequate time for the postal service to deliver, and for us to process your generous gift.

Gifts that pay you income

Many people like to make a gift that provides a tax deduction, pays income to them every year of their life – all while knowing that the gift will make a legacy impact for future generations. This type of gift is called a Charitable Gift Annuity, and it is a simple agreement we prepare for you. Contact the church office for more information.

Gifts in a will

Make a gift to the church in your will and ensure your values are remembered for future generations! If you have included the church in your will, let us know.

If you are planning to make a gift to the church in your will, below is a sample language to share with your estate planning attorney to be sure your intentions will be made and strengthen the church for future generations!

If your gift is to be your residuary estate:

“All of the rest, residue and remainder of my property and estate, including any lapsed or disclaimed legacies of any character, whenever acquired and wherever situated, to which I or my estate may be in any manner entitled at the time of my death, including any property or estate as to which I may have any power of disposition or appointment (all of which is my “residuary estate”), shall be disposed of as follows:

I give, bequeath and devise my residuary estate in fee simple absolute to the Soteria Des Moines (Tax ID No.), located at 53250 SE Soteria Ave.

West Des Moines, IA 50265, for the benefit of ministry activities.”

If your gift is to be a percentage of your residuary estate:

“All of the rest, residue, and remainder of my property and estate, including any lapsed or disclaimed legacies, of any character, whenever acquired and wherever situated, to which I or my estate may be in any manner entitled at the time of my death, including any property or estate as to which I may have any power of disposition or appointment (all of which is my “residuary estate”), shall be disposed of as follows:

I give, bequeath and devise _____ percent ( ___%) of my residuary estate in fee simple absolute to Soteria Des Moines (Tax ID No.), located at 53250 SE Soteria Ave. West Des Moines, IA 50265 for the benefit of ministry activities.”

If your gift is to be a specific amount of cash or securities:

“I give, bequeath and devise ___________ dollars ($ _______) or ______ shares of my ________ stock to the ministry activities for the benefit of ministry activities”

If your gift is real estate:

“I hereby direct my [executor/executrix/personal representative] to sell my real estate located at [address/city/state], and give the net sales proceeds to Soteria Des Moines (Tax ID No.), located at 53250 SE Soteria Ave. West Des Moines, IA 50265 for the benefit of ministry activities.”

Donor-Advised Funds

We accept donations from Donor-Advised Funds for any ministry program of the church! For donor-advised funds, our name may appear in several different forms:

- Soteria Des Moines: A Baptist Church

- Soteria Church

- Willow Creek Baptist Church

Soteria’s tax identification number (EIN) is. When completing your grant recommendation, please match our EIN to your request, as we are often confused with other institutions that use Soteria or Willow Creek in their names. Please have your provider include your name and what you want your gift to support with the grant check. Please have your provider mail your gift to:

Soteria Des Moines

53250 SE Soteria Ave. West Des Moines, IA 50265